Employee Meals Tax Deduction 2024

Employee Meals Tax Deduction 2024 – It’s that time of year when most business owners are looking back on their 2023 numbers and trying to uncover expenses that could potentially lower their tax bill. Is this you? If so, let’s dive into . 9. Business Meals For business meals to be tax deductible, the business owner or an employee must have been present for the meal, it must have been purchased from a restaurant and it cannot have .

Employee Meals Tax Deduction 2024

Source : ledgergurus.comHow to Deduct Meals and Entertainment in 2024

Source : www.bench.coCheck, Please: Deductions for Business Meals and Entertainment

Source : www.ellinandtucker.comBusiness related Meals and Entertainment under Tax Reform Conway

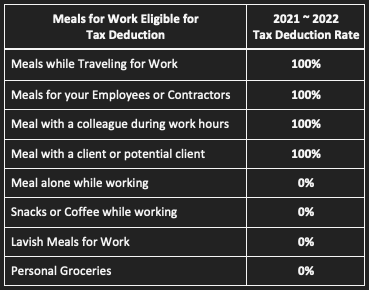

Source : www.cdscpa.comMeals & Entertainment Deductions for 2021 & 2022

Source : www.cainwatters.comDeducting Meals as a Business Expense

Source : www.thebalancemoney.comBusiness Meal Tax Deduction for Freelancers and Small Business

Source : www.blog.priortax.com100% Deduction for Business Meals in 2021 and 2022 Alloy Silverstein

Source : alloysilverstein.com25 Small Business Tax Deductions (2024)

Source : www.freshbooks.com2024 Tax Breaks: Meals & More Bette Hochberger, CPA, CGMA

Source : bettehochberger.comEmployee Meals Tax Deduction 2024 Meal and Entertainment Deductions for 2023 2024: Deductions, also sometimes called tax write-offs was not “lavish or extravagant,” you or your employee were at the meal, one of your business contacts got the meal, and the cost of the . For example, most taxpayers can no longer take a deduction for expenses they incur as an employee and the meals aren’t “lavish or extravagant.” Consult with a tax professional if .

]]>

:max_bytes(150000):strip_icc()/deducting-business-meals-and-entertainment-expenses-398956-Final-edit-9a8310ac2d5f422c87530d3d085e45d6.jpg)